Introduction: Why an Emergency Fund is Non-Negotiable

Life is unpredictable—especially when you’re raising twins or managing a large family. Whether it’s a sudden job loss, an unexpected medical bill, or a major car repair, emergencies can strike at any time. Without a financial cushion, these situations can quickly spiral into stress, debt, or even financial ruin. That’s where an emergency fund comes in.

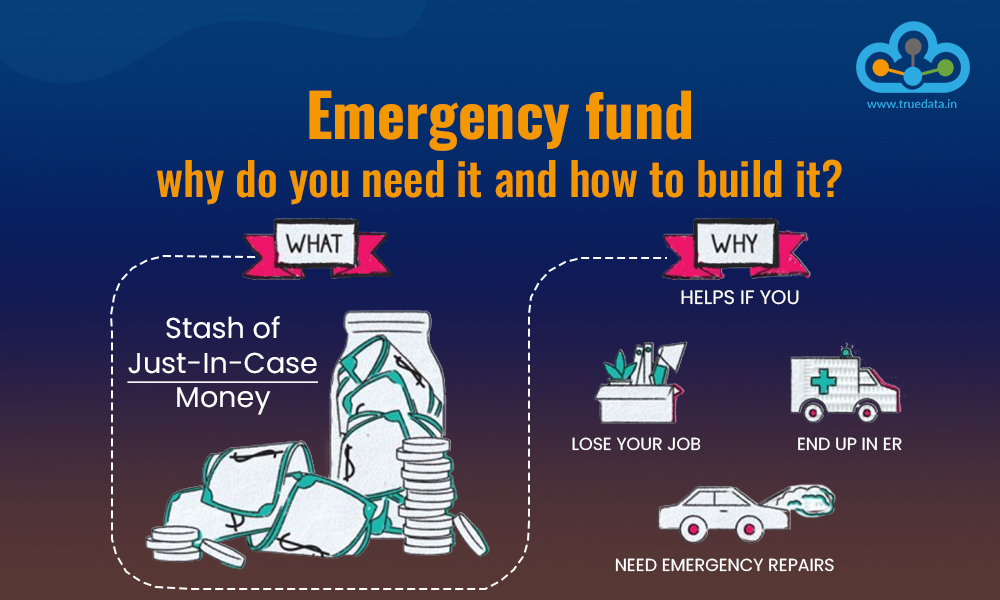

An emergency fund is a dedicated savings account designed to cover unexpected expenses or financial setbacks. It’s your financial safety net, ensuring you’re prepared for life’s curveballs—like when your twins simultaneously outgrow their shoes or your car breaks down on the way to daycare.

In this comprehensive guide, we’ll walk you through:

✔ How much to save (including adjustments for families with twins)

✔ Where to keep your emergency fund (high-yield accounts vs. traditional savings)

✔ Smart strategies to build your fund faster

✔ Common mistakes to avoid

Why You Need an Emergency Fund (Especially with Twins!)

The Harsh Reality: Most Americans Aren’t Prepared

A 2023 Bankrate survey found that 56% of Americans cannot cover a $1,000 emergency expense with savings. For parents of twins, unexpected costs (double diapers, twin-sized medical bills, or dual childcare needs) can hit even harder.

How an Emergency Fund Protects You

✅ Peace of mind – No more panic when surprises arise.

✅ Financial independence – Avoid loans or borrowing from family.

✅ Debt prevention – Skip high-interest credit cards when your twins need urgent dental work.

Real-Life Scenarios Where an Emergency Fund Saves the Day

- Job loss – Covers rent/mortgage while you search for work.

- Medical emergencies – Even with insurance, copays add up fast.

- Car repairs – Critical when you’re shuttling twins to school/activities.

- Home repairs – A broken furnace can’t wait when you have babies.

How Much Should You Save? (The 3-6 Month Rule)

Standard Recommendation

Financial experts suggest 3-6 months’ worth of living expenses. Here’s how to calculate yours:

- Add essential monthly costs:

- Rent/mortgage

- Utilities

- Groceries (budget extra for twins!)

- Transportation

- Insurance

- Multiply by 3 (minimal cushion) or 6 (robust safety net).

📌 Example: If your monthly expenses are 4,0(higher for families with twins), aim for 4,000 (higher for families with twins), aim for 12,000–$24,000.

Adjust for Your Situation

- Single-income families: Save 6+ months (no backup earner).

- Freelancers/gig workers: Aim for 6-12 months (irregular income).

- Parents of twins: Add 10–20% buffer for unexpected twin costs.

Where to Keep Your Emergency Fund

Your fund must be liquid (easily accessible) but separate from daily spending. Best options:

Account Type

Pros

Cons

High-yield savings (Ally, Marcus)

Earn 4–5% APY

Lower returns than investments

Money market account

Check-writing, higher interest

May have minimum balances

Traditional savings

Easy access

Low interest (~0.01% APY)

🚫 Avoid: Stocks, crypto, or CDs—too risky or illiquid for emergencies!

How to Build Your Emergency Fund (Even on a Tight Budget)

Step 1: Start Small

- Save 500–500–1,000 first (a “mini emergency fund”).

- Then work toward 3-6 months’ expenses.

Step 2: Cut Expenses

- Cancel unused subscriptions (saves 20–20–50/month).

- Meal prep (dining out with twins is expensive!).

- Buy secondhand (clothes, toys, gear for twins).

Step 3: Automate Savings

- Set up auto-transfers (e.g., $200/paycheck).

- Apps like Digit or Capital save spare change.

Step 4: Boost Income

- Side hustles (freelancing, Uber, babysitting).

- Sell unused items (strollers, baby clothes).

Maintaining Your Emergency Fund

Replenish After Use

Used funds for a twin-related emergency? Prioritize refilling it.

Annual Checkups

Review your fund each year—twin expenses grow as they age (sports, braces, etc.).

Avoid Temptation

This isn’t for vacations or Black Friday deals! Keep it in a separate account.

Emergency Fund vs. Other Savings

Fund Type

Purpose

Examples

Emergency fund

True emergencies

Medical bills, job loss

General savings

Planned expenses

Vacation, new laptop

Climate emergency fund*

Disaster prep

Storm repairs, evacuation

Emerging market funds*

Investments

High-growth stocks

*Not for emergencies! These are long-term investments.

Conclusion: Start Today!

An emergency fund isn’t a luxury—it’s a lifesaver, especially for families with twins. Follow these steps: 1️⃣ Calculate your 3–6-month target (adjust for twin costs).

2️⃣ Open a high-yield savings account.

3️⃣ Automate contributions (even $50/week adds up)

FAQs

1. What counts as an emergency?

→ Necessary, unexpected costs (hospital bills, car breakdowns). Not “I want a new iPhone.”

2. Should I save while paying off debt?

→ Yes! Save $1,000 first, then attack high-interest debt.

3. How can parents of twins save faster?

→ Bulk-buy diapers, use hand-me-downs, and automate savings.

4. Where’s the best place to keep the fund?

→ High-yield savings account (easy access + earns interest).

.