Credit card debt can experience like a heavy weight for your shoulders, but the right statistics is that it’s no longer insurmountable. With the right strategies, area, and a easy plan, you may repay your credit score card debt and regain manage of your monetary existence. In this guide, we’ll stroll you via actionable steps, tested techniques, and professional recommendations that will help you address your debt efficaciously. Whether you’re handling a small balance or a mountain of debt, this newsletter will offer the system you want to benefit financial freedom.

Why Paying Off Credit Card Debt Matters

Before diving into the “how,” permit’s speak approximately the “why.” Credit card debt is one of the most high priced kinds of debt because of high-hobby prices, that can range from 15% to twenty-five% or extra. According to the Federal Reserve, the common credit score card debt consistent with circle of relatives within the U.S. Is $6,270 as of 2023. Carrying this debt not simplest costs you coins in interest but also can negatively effect your credit score score, limit your financial opportunities, and reason stress.

Paying off your credit rating score card debt is a vital step towards conducting economic stability. It frees up your income for economic savings, investments, and different financial goals, like shopping for a domestic or making plans for retirement.

Step 1: Assess Your Debt Situation

Understand Your Total Debt

The first step in paying off credit score rating card debt is to recognize precisely how lots you owe.

Gather all of your credit score card statements and list out the following for each card:

Current stability

Interest fee (APR)

Minimum month-to-month charge

This will provide you with a clear image of your debt and help you prioritize which playing playing cards to repay first.

Step 2:Calculate Your Debt-to-Income Ratio

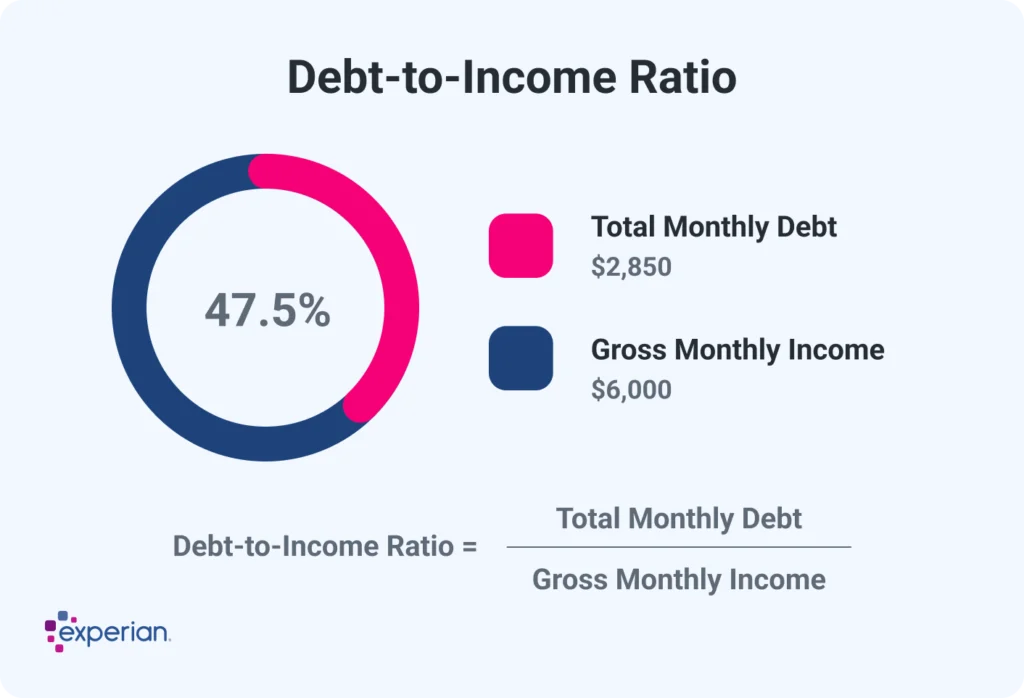

Your debt-to-income (DTI) ratio is a key metric that creditors use to assess your monetary fitness.

To calculate it:

Add up all your monthly debt bills (consisting of credit playing cards, loans, and mortgages).

Divide that variety through your gross monthly income.

Multiply through the usage of 100 to get a percentage.

A excessive DTI ratio (above 40%) shows that you will be overextended and want to take instant movement to lessen your debt.

Create a Budget

Track Your Spending

To unfastened up cash for debt compensation, you want to realize where your coins goes. Use budgeting equipment like Mint, YNAB (You Need A Budget), or even a smooth spreadsheet to music your profits and expenses.

Cut Unnecessary Expenses

Identify areas wherein you can lessen once more.

For example:

Cancel unused subscriptions.

Reduce ingesting out and cook dinner at home.

Shop for inexpensive coverage or software program carriers.

Allocate Funds to Debt Repayment

Step 3: Choose a Debt Repayment Strategy

Once you’ve trimmed your expenses, allocate the extra money toward paying off your credit score rating card debt. Even small quantities can make a big difference through the years.

There are numerous showed techniques for paying off credit rating card debt. Choose the one that nice fits your financial scenario and individual.

1. The Debt Snowball Method

This approach, popularized through financial professional Dave Ramsey, makes a speciality of paying off your smallest debts first. Here’s how it works:

List your debts from smallest to biggest.

Make minimal payments on all money owed except the smallest one.

Put as much money as viable in the direction of the smallest debt till it’s paid off.

Repeat the procedure with the subsequent smallest debt.

Why it truly works: The quick wins from paying off smaller money owed can increase your motivation and preserve you on target.

2. The Debt Avalanche Method

This approach prioritizes money owed with the best interest costs. Here’s the way to do it:

List your debts from maximum to lowest interest fee.

Make minimum bills on all debts except the only with the very excellent interest rate.

Put as a good buy money as viable within the course of the very quality-hobby debt till it’s paid off.

Move without delay to the following maximum-hobby debt.

Why it virtually works: You’ll keep cash on hobby over the years, making it a price-powerful approach.

3. Balance Transfer Cards

If you have got perfect credit score, endure in mind transferring your excessive-interest credit score card balances to a zero% APR balance transfer card. These playing cards offer an introductory length (normally 12-18 months) without a interest, allowing you to pay down your debt quicker.

Tip: Be advantageous to study the awesome print and recognize any transfer costs or put up-introductory hobby fees.

4. Debt Consolidation Loans

A debt consolidation mortgage permits you to combine more than one credit card money owed into a unmarried mortgage with a lower interest price. This simplifies your payments and may prevent coins on hobby.

Tip: Compare loan gives from more than one creditors to locate the quality phrases.

Step 4: Increase Your Income

If your present day income isn’t sufficient to make a dent for your debt, take into account locating tactics to earn extra money. Here are some thoughts:

Freelancing or aspect gigs: Offer your abilties on systems like Upwork or Fiverr.

Sell unused items: Declutter your private home and sell devices on eBay, Facebook Marketplace, or Poshmark.

Ask for a decorate: If you’ve been excelling at your pastime, it is probably time to negotiate a better profits.

Step 5: Avoid Accumulating More Debt

While paying off your present debt, it’s important to keep away from including to it. Here’s how:

Stop the usage of your credit cards: Switch to cash or debit for regular purchases.

Build an emergency fund: Having monetary financial savings can save you you from relying on credit score gambling playing cards for surprising charges.

Practice aware spending: Before creating a purchase, ask yourself if it’s a need or a want.

Step 6: Monitor Your Progress

Tracking your development is important for staying advocated. Use a debt payoff tracker to visualise how tons you’ve paid off and what kind of is left. Celebrate small milestones along the manner to hold yourself stimulated.

FAQs About Paying Off Credit Card Debt

1. How lengthy will it take to repay my credit score card debt?

The time it takes to pay off your debt depends on factors like your general balance, interest fees, and what type of you can control to pay for to pay every month. Use a debt compensation calculator to estimate your timeline.

2. Will paying off my credit score rating card debt enhance my credit score rating?

Yes! Paying off your credit score card debt can decrease your credit score usage ratio, it really is a key detail for your credit score score. It can also display accountable economic conduct to creditors.

3. Should I pay off my credit score card debt or save coins first?

It’s normally a super idea to attention on paying off excessive-interest debt first, because the hobby fees can outweigh the returns from savings. However, it’s additionally crucial to have a small emergency fund (e.g., $1,000) to avoid relying on credit gambling playing cards for unexpected prices.

4. What if I can’t give you the cash for my minimal payments?

If you’re struggling to make minimum bills, contact your credit score card organisation to talk about your options. They also can offer hardship packages, lower interest rates, or changed charge plans.

Conclusion: Take Control of Your Financial Future

Paying off credit score rating card debt is a adventure that requires patience, subject, and a strong plan. By assessing your debt, developing a price range, choosing a compensation approach, and retaining off new debt, you could make steady development toward economic freedom. Remember, each payment brings you one step inside the route of your purpose.

Ready to take step one? Start through list out your money owed and growing a rate range nowadays. If you positioned this guide beneficial, percentage it with a pal or family member who could in all likelihood benefit from it. Together, we will wreck unfastened from the cycle of credit card debt and build a brighter economic destiny.

By following these actionable steps and staying dedicated in your plan, you’ll no only handiest pay off your credit card debt but also foster healthy financial behavior at the way to serve you for future years. Let’s get started!