Retirement is one of those milestones that feels a way away—till it isn’t. Whether you’re simply starting your career or are well into it, the query of ways lots to store for retirement is one of the maximum essential financial choices you’ll make. Yet, studies display that nearly 50% of Americans are worried they gainers have enough saved to retire readily.

The desirable news? With the proper planning, tools, and mindset, you may take manipulate of your financial destiny. This guide will stroll you through the whole lot you want to realize about saving for retirement, from how a lot you’ll need to actionable strategies to get there. Let’s dive in!

Why Saving for Retirement Matters

Before we get into the numbers, let’s communicate about why retirement financial savings is so important.

- Longer Lifespans: People are residing longer than ever. The common existence expectancy in the U.S. Is now79 years, which means your retirement financial savings may also need to ultimate 20–30 years or greater.

- Rising Costs: Inflation and increasing healthcare costs can erode your savings over the years. For instance, the price of healthcare in retirement is envisioned to be $315,000 for a 65-year-vintage couple retiring these days.

- Social Security Uncertainty: While Social Security can help, it’s no longer sufficient to live on. The common month-to-month benefit is just $1,827—infrequently enough to cowl simple residing costs.

The backside line? Your retirement financial savings are your protection internet. The sooner you begin, the higher off you’ll be.

How Much Do You Need to Save for Retirement?

The million-dollar query—literally. While the precise amount varies depending for your life-style, vicinity, and desires, here are a few preferred suggestions to help you determine it out.

The 80% Rule: A Starting Point

Financial professionals regularly advise saving enough to replace 80% of your pre-retirement income. For example, in case you earn 100,000 a year, aim to have 100,000 a year, aim to have 80,000 annually in retirement.

Why 80%? This debts for decreased costs (like commuting fees) but nonetheless leaves room for journey, pursuits, and surprising costs.

The 4% Rule: Calculating Your Retirement Nest Egg

To determine how a whole lot you’ll need saved, use the 4% rule. This rule shows that you can withdraw 4% of your retirement savings yearly with- out walking out of money.

Here’s the way it works:

Estimate your annual retirement charges (e.g. $80,000).

Multiply that number by way of 25 to find your goal financial savings (e.g. 80,000×25=80,000×25=2,000,000).

Example: If you need 80,000 a year in retirement, aim to save 80,000 a year in retirement, aim to save 2 million.

Factors That Influence Your Retirement Savings Goal

Your retirement savings target isn’t one-size-suits-all. Consider those factors:

- Lifestyle: Do you propose to tour considerably or live frugally?

- Healthcare Costs: Chronic conditions or long-term care desires can drastically increase costs.

- Debt: Paying off debt earlier than retirement can lessen your monetary burden.

- Inflation: Over time, inflation can reduce the purchasing electricity of your financial savings.

How to Save for Retirement: Actionable Strategies

Now that you recognize how lots to keep, let’s communicate about the way to get there. Here are some demonstrated strategies to construct your retirement nest egg.

1. Start Early and Leverage Compound Interest

The in advance you begin saving, the more time your money has to grow. Thanks to compound hobby, even small contributions can develop drastically through the years.

Example: If you save 500 a month starting at age 25 ,with a 7500 a month starting at age 25, with a 71.2 million via age 65. Wait till 35 to begin, and also, you’ll handiest have $566,000.

2. Take Advantage of Employer-Sponsored Retirement Plans

If your organization offers a 401(ok) or 403(b), make contributions sufficient to get the overall employer match. This is essentially free cash which can increase your financial savings.

Pro Tip: Aim to make contributions at least 15% of your income to retirement debts, along with enterprise suits.

3. Open an IRA

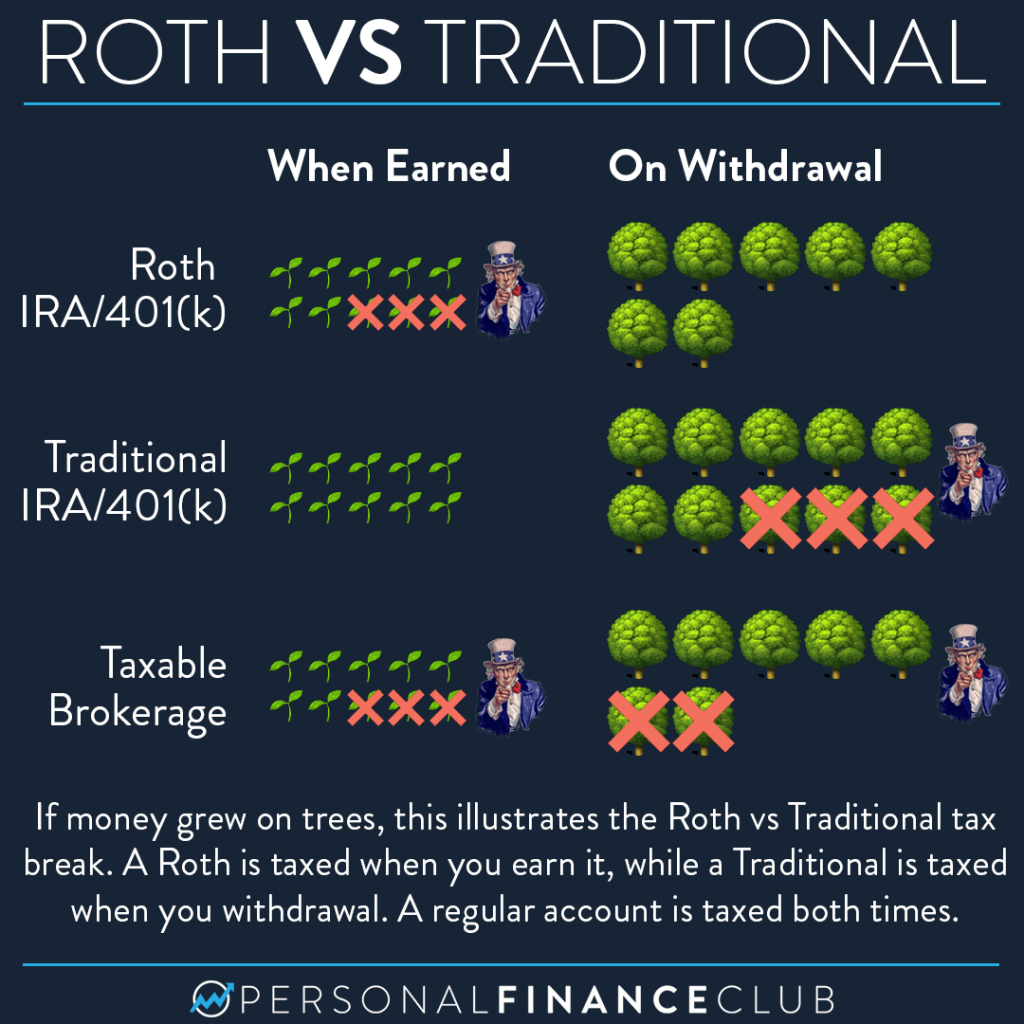

An Individual Retirement Account (IRA) is any other effective tool. With a traditional IRA, contributions are tax-deductible, whilst a Roth IRA offers tax-loose withdrawals in retirement.

2024 Contribution Limits:

401(okay): 23,000(23,000(30,500 if you’re 50+)

IRA: 7,000(7,000(8,000 in case you’re 50+)

4. Diversify Your Investments

Don’t positioned all your eggs in a single basket. A blend of shares, bonds, and other property allow you to manipulate threat and maximize returns.

Asset Allocation by way of Age:

20s–30s: 80–90% stocks, 10–20% bonds

40s–50s: 60–70% shares, 30–forty% bonds

60s+: 40%–50% shares, 50–60% bonds

5. Automate Your Savings

Set up automatic contributions to your retirement accounts. This guarantees you’re continually saving while not having to think about it.

6. Reduce Debt and Cut Expenses

Paying off high-interest debt (like credit cards) and slicing useless expenses can unfastened up extra money for retirement savings.

Common Retirement Savings Mistakes to Avoid

Even with the satisfactory intentions, it’s smooth to make errors. Here are a few pitfalls to watch out for:

- Not Starting Early Enough: Delaying financial savings can cost you masses of hundreds of greenbacks in misplaced boom.

- Underestimating Healthcare Costs: Plan for scientific charges, which can be higher than anticipated.

- Relying Too Much on Social Security: Social Security should complement your savings, no longer replace them.

- Failing to Rebalance Your Portfolio: Regularly evaluation and adjust your investments to live on the right track.

Conclusion: Take Control of Your Retirement Today

Saving for retirement may also appear daunting, however with the right plan, it’s completely viable. Start with the aid of figuring out how a lot you’ll want, then use techniques like automating savings, maximizing company fits, and diversifying investments to build your nest egg. Avoid not unusual mistakes, and bear in mind: the sooner you begin, the better off you’ll be.

Ready to take the subsequent step? Schedule a session with a financial advisor or use on-line retirement calculators to create a customized plan. Your future self-will thanks!

By following this manual, you’ll be nicely in your way to a stable and snug retirement. Don’t wait—start saving today!

FAQs About Saving for Retirement

1. How much have to I save every month for retirement?

Aim to shop 15–20% of your earnings, along with business enterprise contributions. If that’s not viable, start with what you can and boom through the years.

2. Can I retire with $1 million?

It depends on your life-style and costs. For many, $1 million is a great start line, however you may need more in case you plan to journey or live in a high-fee vicinity.

3. What if I’m behind on retirement financial savings?

It’s never too overdue to start. Increase your contributions, postpone retirement, or take into account part-time paintings to seize up.

4. Should I repay debt or shop for retirement?

Focus on high-interest debt first, but attempt to make contributions sufficient to get any corporation healthy in your retirement plan.

5. How do I calculate my retirement desires?

Use the 4% rule or consult a financial marketing consultant to create a personalized plan.