Debt can enjoy like a heavy weight for your shoulders, but there’s a way to lighten the weight: debt consolidation loans. If you’re juggling multiple payments, excessive-hobby fees, and mounting stress, consolidating your debt might be the answer you’ve been trying to find. In this entire guide, we’ll discover the top-notch debt consolidation loans, how they paintings, and actionable hints that will help you make the proper economic choice.

Whether you’re managing credit score card debt, personal loans, or clinical bills, this newsletter will equip you with the recognize-how to take control of your finances. Let’s dive in!

What Are Debt Consolidation Loans?

Debt consolidation loans are a kind of private mortgage designed to mix multiple debts into a single, conceivable price. Instead of maintaining a tune of severe due dates and interest rates, you’ll have one monthly charge with a tough and fast interest rate and time period.

How Do Debt Consolidation Loans Work?

Apply for a Loan: You follow for a debt consolidation mortgage from a financial group, credit score rating score union, or online lender.

Pay Off Existing Debts: If permitted, the lender will pay off your present debts.

Make One Monthly Payment: You repay the mortgage in constant monthly installments over a fixed time period.

This technique simplifies your charge range and may save you coins on interest if you secure a decrease fee than what you’re currently paying.

Why Consider Debt Consolidation Loans?

Debt consolidation loans offer several advantages:

Simplify Your Finances: One fee in vicinity of more than one due date.

Lower Interest Rates: Potentially reduce your average interest costs.

Improve Your Credit Score: Timely payments can improve your credit rating.

Fixed Repayment Terms: Know precisely even as you’ll be debt loose.

According to a 2023 document with the useful resource of the Federal Reserve, the not unusual credit score rating score card hobby rate is over 20%. Consolidating immoderate-hobby debt right into a lower-price loan can prevent plenty of bucks in the end.

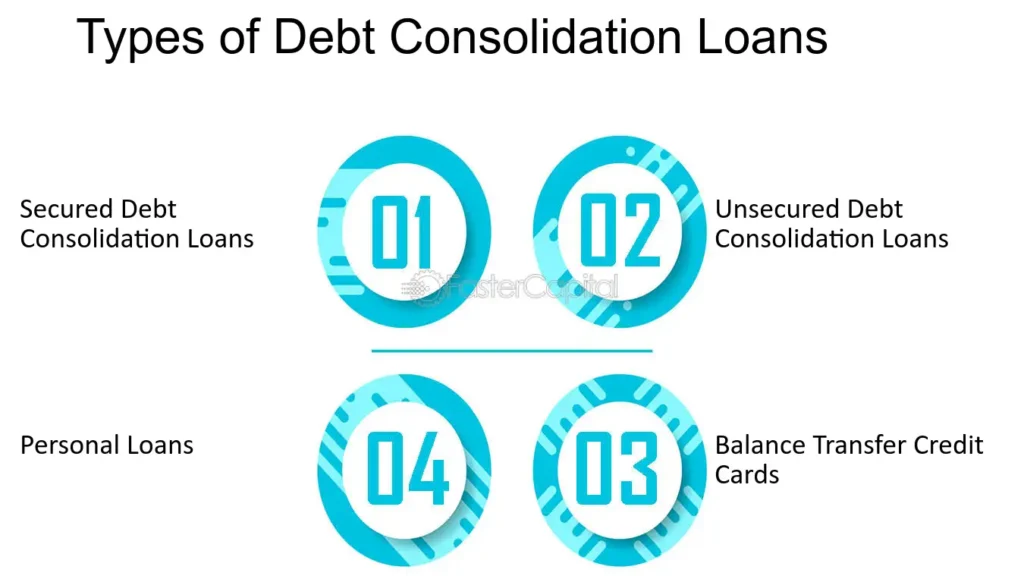

Types of Debt Consolidation Loans

Not all debt consolidation loans are created identical. Here are the most commonplace kinds:

1. Personal Loans

Personal loans are unsecured loans that may be used for almost any motive, which include debt consolidation. They commonly have consistent hobby prices and terms starting from 2 to 7 years.

Best for: Borrowers with appropriate to terrific credit.

2. Balance Transfer Credit Cards

Balance transfer playing cards assist you to bypass immoderate-hobby credit rating score card debt to a current card with a 0% introductory APR for a constrained time (commonly 12-18 months).

Best for: Those who can pay off their debt within the introductory length.

3. Home Equity Loans or HELOCs

If you own a home, you could use a domestic equity mortgage or line of credit score (HELOC) to consolidate debt. These loans use your property as collateral, providing decrease hobby expenses however higher chance.

Best for: Homeowners with large fairness and strong earnings.

4. Debt Management Plans (DMPs)

While no longer a loan, DMPs are presented through credit score rating counseling groups. They negotiate lower interest prices together along with your creditors and combine your bills into one.

Best for: Those suffering to make minimum bills.

How to Choose the Best Debt Consolidation Loan

With so many options, how do you pick the proper one?

Follow those steps:

1. Check Your Credit Score

Your credit score rating plays a big feature inside the hobby price you’ll qualify for.

Generally:

720+: Excellent credit (lowest expenses).

650-719: Good credit (competitive prices).

Below 650: Fair or terrible credit score (better expenses).

Use free tools like Credit Karma or Experian to test your score.

2. Compare Interest Rates and Fees

Look for loans with the lowest APR (annual percentage fee), which includes hobby and charges.

Watch out for:

Origination fees

Prepayment consequences

Late payment prices

3. Evaluate Loan Terms

Choose a time period that balances low priced monthly payments with an inexpensive compensation timeline. Longer terms mean decreases payments but higher popular interest fees.

4. Read Reviews and Check Lender Reputation

Research creditors on structures like Trustpilot or the Better Business Bureau to make certain they’re dependable and purchaser friendly.

Top 5 Debt Consolidation Loans of 2025

Here are some of the fantastic debt consolidation loans to be had these days:

1. SoFi

Pros: No prices, competitive prices, unemployment safety.

Cons: Requires correct credit score.

2. Light Stream

Pros: Low fees, no fees, fast investment.

Cons: Strict credit score necessities.

3. Discover Personal Loans

Pros: No origination expenses, bendy terms.

Cons: No co-signers allowed.

4. Up start

Pros: Considers possibility credit data, rapid approval.

Cons: High APRs for lower credit scores.

5. Payoff

Pros: Focuses on credit card debt, no expenses.

Cons: Limited loan amounts.

Tips for Success with Debt Consolidation Loans

Create a Budget: Track your earnings and prices to make sure you may manage to pay for the brand-new fee.

Avoid New Debt: Don’t rack up new charges whilst paying off your consolidation mortgage.

Set Up Automatic Payments: Avoid overdue costs and improve your credit score.

Monitor Your Progress: Regularly assessment your debt reimbursement plan to stay at the right music.

Conclusion: Take Control of Your Debt Today

Debt consolidation loans can be an effective tool to simplify your price range, reduce interest prices, and accumulate monetary freedom. By know-how your alternatives, evaluating creditors, and following first-class practices, you could make a knowledgeable choice that gadgets you at the course to achievement.

Ready to take the subsequent step? Start by manner of checking your credit rating and comparing mortgage gives nowadays. Your adventure to a debt-unfastened lifestyles starts now!

FAQs About Debt Consolidation Loans

1. Will a debt consolidation loan harm my credit rating?

Initially, your rating might also dip barely due to the difficult inquiry. However, well timed payments can improve your score over time.

2. Can I consolidate pupil loans with a debt consolidation mortgage?

Yes, however federal scholar loans can also lose advantages like profits-driven reimbursement plans. Consider refinancing as a substitute.

3. What’s the difference between debt consolidation and debt settlement?

Debt consolidation combines debts into one mortgage, even as debt agreement entails negotiating to pay less than you owe. Settlement can damage your credit score.

4. How a lot can I store with a debt consolidation mortgage?

Savings rely on your modern interest expenses and the new mortgage’s APR. Use online calculators to estimate your economic financial savings.