Debt can feel like a heavy weight on your shoulders, but what if there were a demonstrated approach to help you get debt-free? Enter the Debt Snowball Method, a well-known debt reimbursement method that has helped hundreds of humans regain manipulate of their budget. Whether you’re drowning in credit score card debt, student loans, or private loans, this approach can offer an easy path to financial freedom.

In this comprehensive manual, we’ll damage down the entirety you want to recognize approximately the Debt Snowball Method, collectively with how it works, why it’s effective, and actionable steps to get began out. By the give up of this text, you’ll have the tools and self-belief to address your debt head-on.

What Is the Debt Snowball Method?

The Debt Snowball Method is a debt repayment method in which you attention on paying off your smallest debts first even as making minimal payments on larger money owed. Once the smallest debt is paid off, you roll the amount you were paying on that debt into the subsequent smallest stability. This creates a “snowball effect,” allowing you to advantage momentum as you take away every debt.

Developed via non-public finance professional Dave Ramsey, this technique is designed to provide quick wins, that may raise your motivation and preserve you on the right track.

Why the Debt Snowball Method Works

1. Psychological Wins

One of the maximum critical benefits of the Debt Snowball Method is its focus on small victories. Paying off smaller debts first gives you a revel in of achievement, that can encourage you to address larger money owed. According to a check via Harvard Business Review, small wins can notably enhance motivation and productiveness.

2. Simplifies Debt Repayment

Instead of juggling multiple debts with various hobby fees, the Debt Snowball Method simplifies the system. You most effective want to attention on one debt at a time, making it less tough to live prepared and committed.

3. Builds Momentum

As you repay each debt, the quantity you could place towards the next debt will increase. This creates a snowball impact, permitting you to deal with huge debts greater rapid through the years.

How to Use the Debt Snowball Method: A Step-by means of-Step Guide

Ready to get commenced? Follow those steps to put into effect the Debt Snowball Method efficaciously:

Step 1: List All Your Debts

Start via listing all your debts, together with credit playing cards, pupil loans, automobile loans, and personal loans.

Include the following information for every debt:

Creditor name

Total stability

Minimum monthly fee

Example:

Credit Card A: 500 balances, 500 balance, 25 minimum fees

Student Loan: 10,000 balances, 10,000 balance, 100 and 50 minimum charges

Car Loan: 5,000 balances, 5,000 balance, 100 minimal rates

Step 2: Order Your Debts from Smallest to Largest

Arrange your debts so as in their normal balance, from smallest to biggest. Ignore the interest costs for now—this method specializes in stability length, not interest.

Example:

Credit Card A: $500

Car Loan: $5,000

Student Loan: $10,000

Step 3: Make Minimum Payments on All Debts Except the Smallest

Continue making the minimum bills on all of your money owed besides the smallest one. For the smallest debt, throw as plenty money as you may at it each month.

Example:

Credit Card A: Pay a hundred/month (instead of the minimum 100/month (instead of the minimum25)

Car Loan: Pay $200/month (minimal fee)

Student Loan: Pay $one hundred fifty/month (minimum charge)

Step 4: Celebrate When You Pay Off the First Debt

Once you’ve paid off the smallest debt, rejoice your win! This is a vital step because it reinforces your motivation to preserve going.

Step 5: Roll Over Payments to the Next Debt

Take the quantity you had been paying on the first debt and upload it to the minimum rate of the next smallest debt.

Example:

Credit Card A: Paid off

Car Loan: Pay 300/month (300/month (100 minimal + $100 from Credit Card A)

Student Loan: Pay $100 fifty/month (minimum charge)

Step 6: Repeat Until All Debts Are Paid Off

Continue this way till all of your debts are paid off. With every debt you get rid of, your snowball will increase, allowing you to tackle larger debts extra short.

Debt Snowball Method vs. Debt Avalanche Method

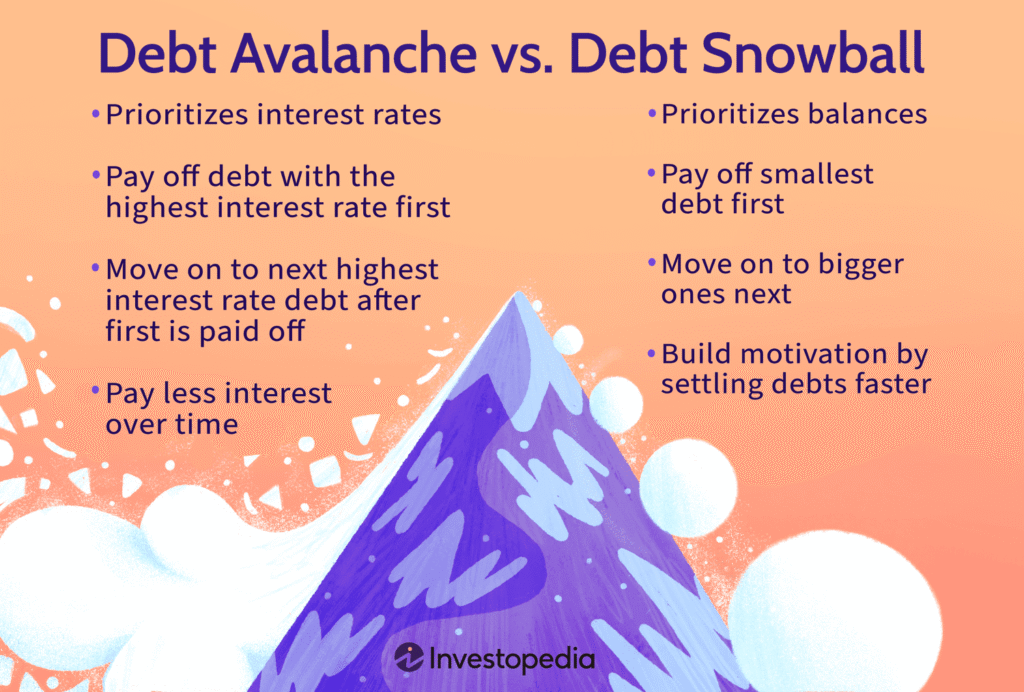

While the Debt Snowball Method makes a specialty of paying off the smallest debts first, the Debt Avalanche Method prioritizes money owed with the very great interest expenses.

Here’s a brief assessment:

Aspect, Debt Snowball Method, Debt Avalanche Method

Focus, Smallest balances first, Highest hobby expenses first

Motivation, Quick wins improve morale, Saves greater on interest

Best For, People who need motivation, People who need to preserve money

Which one have to you pick out? If you want short wins to live encouraged, go together with the Debt Snowball Method. If you’re extra targeted on saving cash in the end, recall the Debt Avalanche Method.

Tips for Success with the Debt Snowball Method

Create a Budget

A price range is vital for releasing up more money to position in the direction of your debts. Use gear like YNAB (You Need a Budget) or Mint to song you’re spending and perceive regions in which you can lessen again.

Build an Emergency Fund

Before aggressively paying off debt, store $1,000 as a starter emergency fund. This will save you from going similarly into debt if a sudden fee arises.

Avoid Taking on New Debt

Commit to dwelling interior your approach and avoid the usage of credit score cards or putting off new loans at the same time as you’re paying off debt.

Increase Your Income

Consider taking on an issue hustle, freelancing, or selling unused objects to generate more profits for debt repayment.

Stay Consistent

Consistency is key to the Debt Snowball Method’s success. Stick on your plan, even when development feels gradual.

Real-Life Example of the Debt Snowball Method

Let’s test a real-life example to appearance how the Debt Snowball Method works in practice:

Debts:

Credit Card A: 1,000balance, 1,000balance, 50 minimum rates

Credit Card B: 2,500balance, 2,500balance, 75 minimal fees

Student Loan: 8,000balance, 8,000balance, 2 hundred minimum rates

Monthly Budget for Debt Repayment: $500

Step 1: Pay 275 toward Credit Card A (275 toward Credit Card A (50 minimal + 225extra).

Step2: Once Credit Card A is paid off, roll the 225 extra).

Step3: Once Credit Card A is paid off, roll the 275 into Credit Card B’s price (75 minimum + 75 minimum +275=350total).

Step4: After Credit Card B is paid off, apply the 350 total).

Step5: After Credit Card B is paid off, apply the 350 to the Student Loan (200 minimum + 200 minimum + 350 = $550 total).

By following this method, you’ll pay off your money owed faster and advantage momentum with every victory.

Conclusion: Take Control of Your Debt Today

The Debt Snowball Method is more than just a debt compensation technique—it’s an attitude shift that empowers you to take control of your charge variety. By specializing in small wins and building momentum, you could take away your money owed one step at a time.

Ready to get started? Grab a pen and paper, list your money owed, and create a plan the use of the Debt Snowball Method. Remember, the journey to monetary freedom begins with an unmarried step.

FAQs About the Debt Snowball Method

1. Does the Debt Snowball Method Work for All Types of Debt?

Yes, the Debt Snowball Method can be used for any form of debt, which encompass credit score gambling cards, student loans, automobile loans, and private loans.

2. What If I Have a Large Debt with a High Interest Rate?

While the Debt Snowball Method makes a specialty of balance period, you can adapt it to prioritize immoderate-hobby money owed if wished. However, sticking to the genuine technique can offer the incentive to stay at the right tune.

3. How Long Does It Take to See Results?

The timeline is based upon on your total debt and how much you can allocate inside the course of compensation every month. Many people begin seeing consequences within a few months.

4. Can I Use the Debt Snowball Method with a Low Income?

Absolutely! The Debt Snowball Method is flexible and can be tailor-made to wholesome any earnings degree. Start small and increase your payments as your monetary scenario improves.