Introduction: Why Understanding ETFs and Mutual Funds Matters

Investing may be a daunting undertaking, in particular even as faced with a plethora of options. Two of the most well-known investment cars are Exchange-Traded Funds (ETFs) and Mutual Funds. Both provide specific blessings and cater to extremely good kinds of consumers. But how do making a decision which one is proper for you? In this whole manual, we’ll damage down the key variations, blessings, and disadvantages of ETFs and Mutual Funds, assisting you are making a knowledgeable preference.

In recent Times, a fast-paced global economy, knowing the nuances of numerous investment options is important. Whether you are a seasoned investor or just starting, understanding the variations among ETFs and Mutual Funds can notably affect your funding strategy. According to a 2022 document with the resource of the Investment Company Institute (ICI), ETFs held 7.2 trillion in assets, while Mutual Funds held 7.2 trillion in MutualFundsheld7.2trillion in assets, even as Mutual Funds held 27.1 trillion. These numbers spotlight the popularity and significance of each investment motor.

But what exactly are ETFs and Mutual Funds? How do they variety, and which one should you select out? Let’s dive in.

What Are ETFs and Mutual Funds?

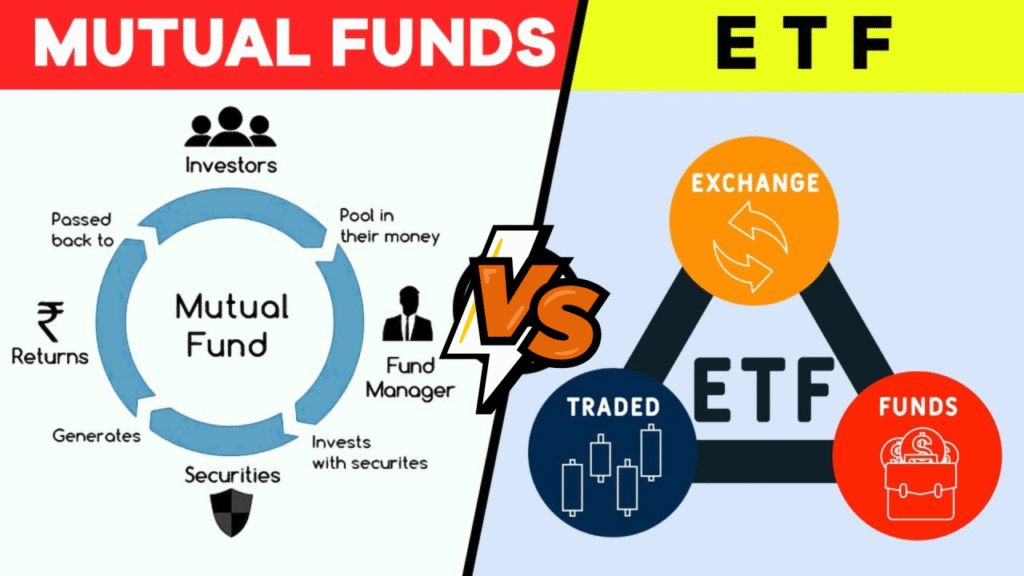

Exchange-Traded Funds (ETFs)

ETFs are funding budget that exchange on inventory exchanges, much like person stocks. They typically tune an index, quarter, commodity, or different property. ETFs offer the strength of trading at some level in the day at market prices, imparting liquidity and transparency.

Mutual Funds

Mutual Funds, however, are funding cars that pool cash from a couple of investors to shop for a several portfolios of stocks, bonds, or specific securities. They are controlled thru expert portfolio managers and are priced at the surrender of the shopping for and promoting day based totally at the internet asset rate (NAV).

Key Differences Between ETFs and Mutual Funds

Understanding the versions amongst ETFs and Mutual Funds is critical for making a knowledgeable funding selection. Here are a few key differences:

1. Trading and Liquidity

- ETFs: Traded like stocks on an exchange, permitting investors to shop for and sell all through the buying and selling day at market prices.

- Mutual Funds: Bought and bought on the cease of the trading day on the NAV rate.

2. Expense Ratios and Fees

- ETFs: Generally, have lower fee ratios compared to Mutual Funds. According to a 2021 study by means of Morningstar, the average rate ratio for ETFs became zero.18%, even as for Mutual Funds, it was zero.50%.

- Mutual Funds: Often include better charges because of energetic management and administrative costs.

3. Minimum Investment Requirements

- ETFs: No minimum investment requirement; you can purchase as little as one percentage.

- Mutual Funds: Often have minimal funding requirements, that may range from 500to500to3,000 or extra.

4. Tax Efficiency

- ETFs: Typically, more tax-efficient due to their precise shape, which lets in for in-type redemptions.

- Mutual Funds: May incur higher capital gains taxes because of common shopping for and promoting of assets in the fund.

5. Investment Strategies

- ETFs: Primarily passively managed, monitoring an index or zone.

- Mutual Funds: Can be either actively or passively controlled, with energetic funds aiming to outperform the market.

Pros and Cons of ETFs and Mutual Funds

ETFs: Pros and Cons

Pros:

- Lower Costs: Generally, decrease rate ratios.

- Tax Efficiency: More tax-efficient because of in-kind redemptions.

- Flexibility: Can be traded at some stage in the day.

- Transparency: Holdings are disclosed day by day.

Cons:

- Trading Costs: May incur brokerage charges.

- Complexity: Can be more complicated for amateur buyers.

- Liquidity Issues: Some area of interest ETFs might also have lower liquidity.

Mutual Funds: Pros and Cons

Pros:

- Professional Management: Managed by way of experienced portfolio managers.

- Diversification: Offers instantaneous diversification.

- Automatic Investing: Options for computerized funding plans.

- Accessibility: Easier for beginner investors to recognize.

Cons:

- Higher Costs: Generally higher price ratios.

- Tax Inefficiency: May incur higher capital gains taxes.

- Less Flexibility: Only traded on the stop of the day.

Practical Tips for Choosing Between ETFs and Mutual Funds

1. Assess Your Investment Goals

- Long-Term Investors: Mutual Funds may be suitable because of expert control and automated funding alternatives.

- Active Traders: ETFs provide flexibility and lower expenses, making them best for frequent buying and selling.

2. Consider Your Risk Tolerance

- Risk-Averse Investors: Mutual Funds with a different portfolio can offer balance.

- Risk-Tolerant Investors: ETFs in specific sectors or commodities may additionally provide higher returns.

3. Evaluate Costs and Fees

- Cost-Conscious Investors: ETFs commonly have decrease price ratios.

- Value-Oriented Investors: Mutual Funds with energetic control may additionally justify better prices in the event that they outperform the marketplace.

4. Think About Tax Implications

- Tax-Sensitive Investors: ETFs are usually more tax-efficient.

- Long-Term Holders: Mutual Funds can be less impactful if held for the long term.

5. Check for Minimum Investment Requirements

- Small Investors: ETFs without minimal investment requirements are extra available.

- Larger Investors: Mutual Funds with higher minimums may also provide extra benefits.

Conclusion: Making the Right Choice for Your Investment Portfolio

Choosing between ETFs and Mutual Funds ultimately relies upon to your character monetary dreams, threat tolerance, and funding approach. ETFs provide decrease charges, tax efficiency, and trading flexibility, making them ideal for active buyers and value-aware traders. Mutual Funds, however, offer expert management, diversification, and ease of use, catering to lengthy-term investors and people looking for balance.

As you navigate your investment adventure, keep in mind to evaluate your dreams, evaluate expenses, and remember tax implications. Both ETFs and Mutual Funds have their particular advantages, and the proper preference will align with your financial goals.

Ready to take the next step? Consult with a financial guide to tailor your funding approach and make the maximum of your portfolio. Happy investing!

By following this manual, you’ll be well-prepared to make a knowledgeable decision between ETFs and Mutual Funds. Whether you’re looking for flexibility, price-performance, or professional management, knowledge of these funding cars will assist you in attaining your financial dreams. Don’t neglect to proportion this text with fellow investors and leave your mind in the comments beneath!

FAQs: Common Questions About ETFs and Mutual Funds

1. Can I Lose Money in ETFs and Mutual Funds?

Yes, both ETFs and Mutual Funds are concern to marketplace risk, and you could lose money if the market declines.

2. Are ETFs Safer Than Mutual Funds?

Not always. Both funding motors carry dangers, and safety relies upon at the underlying property and market situations.

3. Can I Convert a Mutual Fund to an ETF?

Some fund families provide conversion options, however it’s no longer universally to be had. Check with your fund issuer for particular details.

4. Which is Better for Retirement Accounts?

Both may be suitable for retirement accounts. ETFs provide lower charges and tax overall performance, while Mutual Funds offer expert management and automated investment options.

5. How Do I Start Investing in ETFs or Mutual Funds?

You can start with the aid of establishing a brokerage account for ETFs or straight away through a fund issuer for Mutual Funds. Research and choose price range that align with your investment desires.