When faced with a monetary need—whether or not it’s an sudden fee, a chief buy, or debt consolidation—two popular options often come to mind: personal loans and credit playing cards. Both can offer the price range you need, however they work very otherwise. Choosing the proper it is easy to prevent money, reduce stress, and help you gain your monetary goals faster.

But how do you decide which is excellent for your state of affairs? In this comprehensive guide, we’ll spoil down the differences among private loans and credit score cards, discover their execs and cons, and provide actionable insights to help you make an knowledgeable selection. By the end, you’ll recognise exactly which choice aligns with your monetary wishes and goals.

Understanding Personal Loans and Credit Cards

What is a Personal Loan?

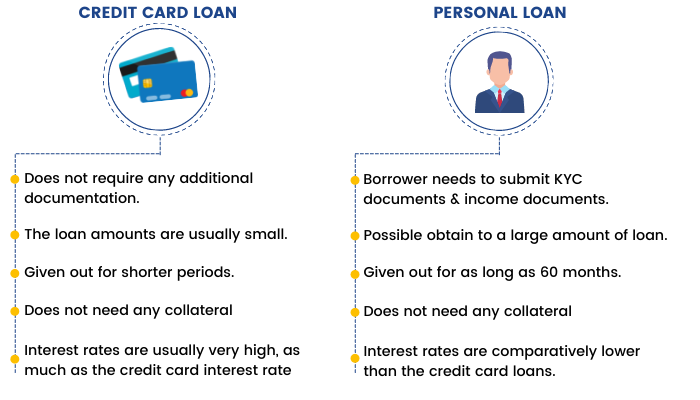

A personal mortgage is a lump amount of money borrowed from a financial institution, credit union, or online lender. It’s generally repaid in constant monthly installments over a set time period, ranging from 1 to 7 years. Personal loans are regularly unsecured, which means they don’t require collateral, and they typically include constant hobby rates.

Key Features of Personal Loans:

Fixed loan amount.

Fixed repayment time period.

Lower hobby costs compared to credit playing cards.

Ideal for massive, one-time prices.

What is a Credit Card?

A credit card is a revolving line of credit that lets in you to borrow money up to a sure limit. You can use it for purchases, cash advances, or balance transfers. Unlike personal loans, credit playing cards have variable interest prices, and also you most effective pay interest on the quantity you carry over every month.

Key Features of Credit Cards:

Revolving credit limit.

Flexible repayment options.

Higher hobby prices as compared to personal loans.

Ideal for quick-term or ongoing costs.

Key Differences Between Personal Loans and Credit Cards

To help making a decision which option is higher in your desires, allow’s evaluate non-public loans and credit cards throughout numerous key factors:

1. Interest Rates

Personal Loans: Typically have lower interest prices, specially if you have true credit. According to the Federal Reserve, the common interest rate for a 24-month personal mortgage is round 11.23% (as of 2023).

Credit Cards: Often include better hobby costs, averaging round 21.19% for money owed assessed hobby. If you carry a balance, this could upload up quickly.

Tip: If you’re seeking to shop on hobby, a personal mortgage is usually the higher choice.

2. Repayment Terms

Personal Loans: Have fixed reimbursement phrases, usually among 1 to 7 years. This makes it simpler to budget and plan your finances.

Credit Cards: Offer flexible repayment alternatives, but there’s no set quit date. If you handiest make minimum payments, you can emerge as paying interest for years.

Tip: If you decide on dependent bills, a private loan is ideal. For brief-time period or flexible borrowing, a credit score card may work better.

3. Borrowing Limits

Personal Loans: Provide a fixed amount in advance, that could range from 1,000to1,000to100,000, depending for your creditworthiness and lender.

Credit Cards: Offer a revolving credit restriction, which may be reused as you pay off your balance. Limits vary extensively, from some hundred bucks to tens of lots.

Tip: For massive, one-time costs, a non-public loan is frequently extra suitable. For ongoing or smaller costs, a credit score card may be extra convenient.

4. Fees and Charges

Personal Loans: May include origination charges (1% to eight% of the mortgage quantity) but typically have fewer expenses than credit playing cards.

Credit Cards: Can have annual costs, overdue price costs, cash advance charges, and overseas transaction prices. These can upload up if you’re now not careful.

Tip: Always examine the high-quality print and compare charges before choosing both option.

When to Choose a Personal Loan

1. Debt Consolidation

If you’ve got high-interest credit score card debt, a personal mortgage will let you consolidate your debt right into a unmarried, lower-interest charge. This can prevent money and simplify your finances.

Example: Let’s say you have got $10,000 in credit card debt at 20% hobby. By consolidating with a non-public mortgage at 10% interest, you may store hundreds in interest over the years.

2. Large, One-Time Expenses

Personal loans are ideal for huge-ticket objects like domestic renovations, scientific payments, or weddings. You’ll understand precisely how lots you’re borrowing and what your monthly payments will be.

3. Fixed Budgeting

If you choose predictable payments, a private mortgage’s fixed interest rate and time period make it simpler to devise your finances.

When to Choose a Credit Card

1. Short-Term Financing

If you want price range for a brief period and may pay off the balance quickly, a credit score card’s interest-free grace period (normally 21-25 days) can be a value-effective alternative.

2. Rewards and Perks

Many credit score cards offer rewards applications, including cashback, journey factors, or reductions. If you repay your balance in full each month, you could take benefit of those advantages without paying hobby.

Example: A cashback credit card that offers 2% back on all purchases can save you 200 annually if you spend 200 annually if you spend 10,000.

3. Emergency Expenses

Credit cards are convenient for sudden expenses, like automobile maintenance or clinical emergencies, whilst you don’t have coins reachable.

Practical Tips for Choosing Between a Personal Loan and a Credit Card

Assess Your Financial Situation: Determine how plenty you need, how lengthy you’ll want to repay it, and your potential to make bills.

Compare Interest Rates: Use on line calculators to examine the whole cost of borrowing for each options.

Check Your Credit Score: A higher credit rating can qualify you for lower interest charges on both private loans and credit score cards.

Read the Fine Print: Look for hidden charges, consequences, and terms that would impact your decision.

Consider Your Spending Habits: If you’re liable to overspending, a personal mortgage’s constant amount might be a better choice.

FAQs About Personal Loans vs Credit Cards

Conclusion: Personal Loan vs Credit Card – Which Should You Choose?

Choosing among a private loan and a credit card in the long run depends for your monetary needs, spending conduct, and repayment potential.

Here’s a brief recap:

Choose a Personal Loan in case you want a large sum of money, select constant payments, or want to consolidate excessive-hobby debt.

Choose a Credit Card if you need quick-time period financing, need to earn rewards, or need flexibility in repayment.

Both alternatives have their region on your monetary toolkit, however the secret’s to use them responsibly. Always compare gives, study the pleasant print, and make a plan to pay off your debt on time.

Call-to-Action (CTA): Still uncertain which alternative is right for you? Reach out to a economic guide or use on line assessment gear to explore your alternatives similarly. Share your mind or questions within the comments underneath – we’d like to listen from you!1. Can I use a personal mortgage to repay credit card debt?

Yes, many people use personal loans to consolidate excessive-interest credit score card debt right into a single, lower-hobby payment.

2. Which is better for constructing credit score: a personal loan or a credit score card?

Both can help construct credit if used responsibly. Credit cards may additionally have a mild facet due to the fact they make a contribution on your credit score usage ratio, that is a key factor to your credit score score.

3. What occurs if I leave out a payment on a personal mortgage or credit score card?

Missing a fee can result in past due fees, accelerated interest charges, and a poor effect for your credit rating. Always prioritize well timed payments.

4. Can I get a non-public mortgage with terrible credit?

Yes, but you may face higher hobby quotes or need a co-signer. Some creditors focus on loans for human beings with negative credit score.

5. Are there tax advantages to the usage of a non-public mortgage or credit score card?

Generally, no. However, in case you use a personal mortgage for commercial enterprise purposes, the interest can be tax-deductible.