When Fowl it entails making plans for retirement, deciding on the right funding automobile is critical. Two of the maximum famous alternatives are the Roth IRA and the Traditional IRA. Both provide unique tax advantages, but they cater to awesome economic situations and retirement dreams. Suppose you’re questioning which one is the excellent wholesome for you, you aren’t alone. According to a 2022 survey thru the Investment Company Institute, 35% of U.S. Households very own an IRA, making it one of the maxima widely used retirement savings instruments.

In this comprehensive manual, we’ll spoil down the critical factor versions among Roth IRA and Traditional IRA, discover their professionals and cons, and provide actionable insights that will help you make an informed decision. Whether you’re a younger expert simply beginning to store or someone toward retirement, this newsletter will equip you with the understand-how to optimize your retirement approach.

What is an IRA?

An Individual Retirement Account (IRA) is a tax-advantaged monetary savings account designed to help people preserve for retirement. There are fundamental forms of IRAs: Roth IRA and Traditional IRA. While every offer tax blessing, they range in how and at the same time as those blessings are applied

Key Features of IRAs

- Tax Advantages: Both IRAs offer tax advantages, but the timing differs.

- Contribution Limits: For 2023, the once-a-year contribution restrict for every Roth and Traditional IRAs is 6,500 or 6,500 or 7,500 in case you’re 50 or older.

- Investment Options: IRAs let you put money into stocks, bonds, mutual price range, and other assets.

- Withdrawal Rules: Each IRA has particular rules approximately while and how you could withdraw charge range without consequences.

Roth IRA vs Traditional IRA: Key Differences

Understanding the variations among these two debts is critical to creating the proper preference. Let’s dive into the specifics.

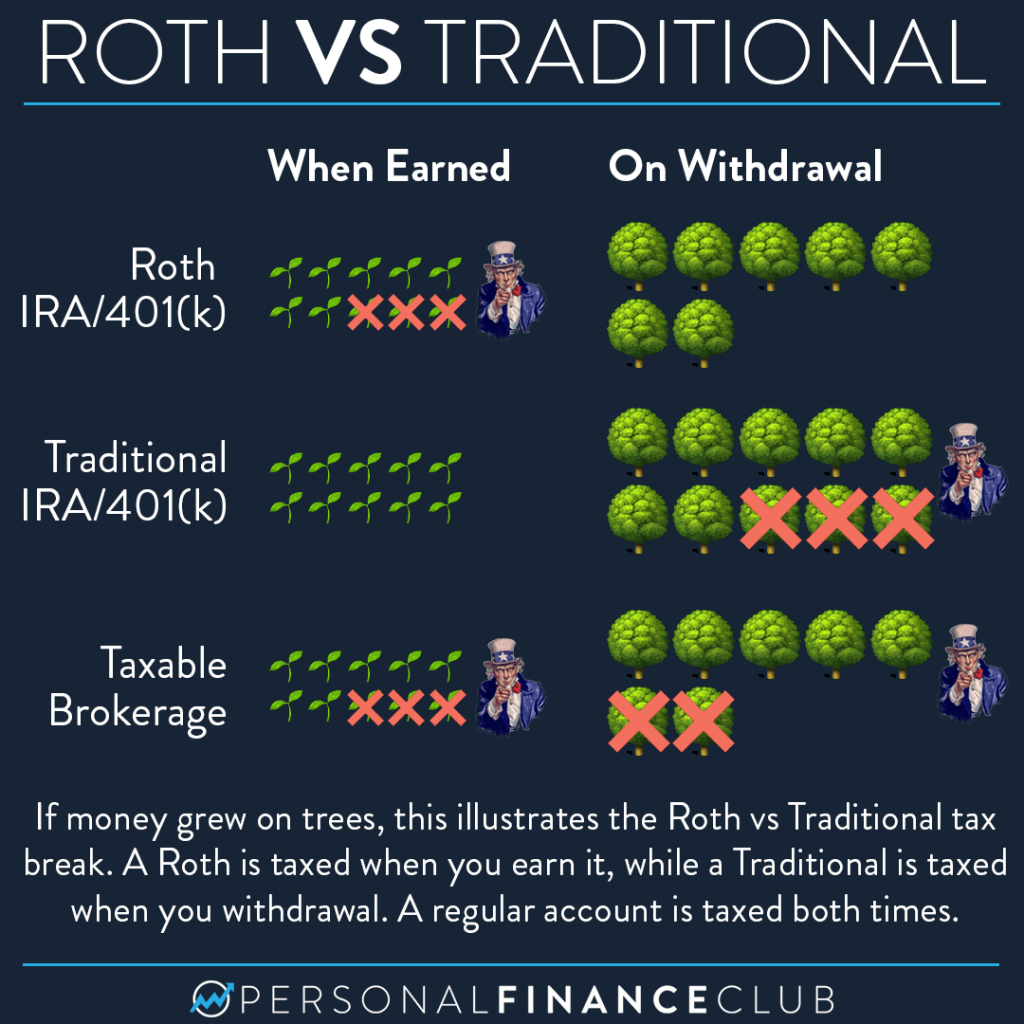

1. Tax Treatment

- Roth IRA: Contributions are made with after-tax dollars; this means that you pay taxes in advance. However, your investments develop tax-unfastened, and certified withdrawals in retirement also are tax-unfastened.

- Traditional IRA: Contributions are made with pre-tax dollars, reducing your taxable earnings in the twelve months you are making a contribution. However, withdrawals in retirement are taxed as normal income.

Example: If you’re making contributions 6,000 to a Roth IRA, you’ve earl ready paid tax Eson that amount. If you contribute 6,000 to a Roth IRA, you’ve earl ready paid tax Eson that amount. If you contribute 6,000 to a Traditional IRA, you may deduct that amount out of your taxable income, probably lowering your tax bill for the 12 months.

2. Income Limits

Roth IRA: There are earnings limits for contributing to a Roth IRA. For 2023, unmarried filers with a modified adjusted gross income (MAGI) above 153,000 and married couples filing jointly with a MAGI above 153,000 and married couples filing jointly with a MAGI above 228,000 are phased out from contributing.

Traditional IRA: While simply every person can make contributions to a Traditional IRA, the tax deductibility of contributions can be restricted if you or your companion are protected via a place of job retirement plan and your income exceeds high-quality thresholds.

3. Required Minimum Distributions (RMDs)

Roth IRA: There are not any required minimal distributions (RMDs) during your lifetime. This technique you could permit your investments increase tax-unfastened for so long as you need.

Traditional IRA: You ought to start taking RMDs at age 73 (as of 2023, up from 72 due to SECURE 2.0 Act modifications). These withdrawals are taxed as regular income.

4. Early Withdrawal Rules

Roth IRA: You can withdraw your contributions (but no longer profits) at any time without consequences or taxes. However, retreating profits earlier than age 59½ may result in taxes and outcomes besides an exception applies.

Traditional IRA: Withdrawals earlier than age 59½ are normally undertaking to a 10% penalty and income taxes, with a few exceptions (e.g. first-time home purchase, scientific costs).

Pros and Cons of Roth IRA and Traditional IRA

To assist you decide which IRA is right for you, permit’s weigh the professionals and cons of every.

Roth IRA

Pros:

- Tax-unfastened increase and withdrawals in retirement.

- No RMDs, taking into consideration extra flexibility in retirement making plans.

- Ability to withdraw contributions penalty-free at any time.

Cons:

- Contributions are made with after-tax dollars, which may also moreover reduce your modern disposable income.

- Income limits may additionally prevent excessive earners from contributing.

Traditional IRA

Pros:

- Contributions may be tax-deductible, lowering your taxable earnings inside the contribution yr.

- No earnings limits for contributions (even though deductibility may be limited).

- Ideal for people who assume to be in a lower tax bracket in retirement.

Cons:

Withdrawals in retirement are taxed as normal income.

RMDs can limit your flexibility and increase your tax burden in retirement.

Which IRA is Right for You?

Choosing among a Roth IRA and a Traditional IRA is predicated upon on your financial scenario, tax bracket, and retirement dreams. Here are a few situations to bear in mind:

Choose a Roth IRA If

- You expect to be in a higher tax bracket in retirement.

- You want tax-unfastened withdrawals in retirement.

- You value the potential of no RMDs.

- You’re a young professional with an extended investment horizon.

Choose a Traditional IRA If

- You assume to be in a decrease tax bracket in retirement.

- You want to reduce your modern taxable income.

- You’re inside the path of retirement and want to maximize your tax deductions now.

Practical Tips for Maximizing Your IRA

Regardless of which IRA you pick, proper here are a few actionable pointers to make the maximum of your retirement economic financial savings:

- Start Early: The in advance you begin contributing, the more time your investments ought to develop. Thanks to compound interest, even small contributions can develop substantially over time.

- Maximize Contributions: Aim to make contributions the maximum allowable amount each 365 days. For 2023, that’s 6,500 or 6,500 or 7,500 in case you’re 50 or older.

- Diversify Your Investments: Don’t placed all of your eggs in a single basket. Spread your investments throughout one in all a kind asset education to lessen threat.

Review Your Strategy Annually: Your economic state of affairs and dreams may additionally alternate through the years. Regularly evaluate your IRA technique to make certain it aligns alongside your retirement plans.

Conclusion: Make an Informed Decision for Your Retirement

Choosing amongst a Roth IRA and a Traditional IRA is a giant preference which can impact your financial future. By understanding the important element variations, weighing the professionals and cons, and considering your specific economic state of affairs, you can choose the account that excellent aligns in conjunction with your retirement desires.

Remember, the sooner you begin saving, the better off you’ll be in the end. Whether you choose the tax-free boom of a Roth IRA or the immediate tax benefits of a Traditional IRA, taking motion today will set you on the route to a solid and comfortable retirement.

Ready to take the following step? Consult with an economic marketing consultant to create a customized retirement plan tailored in your wishes. And don’t overlook to proportion this manual with friends and own family who can also advantage from know-how the differences among Roth and Traditional IRAs. Your future self will thank you!

FAQs About Roth IRA vs Traditional IRA (H2)

1. Can I Have Both a Roth IRA and a Traditional IRA?

Yes, you can have every sort of IRAs. However, your general contributions to all IRAs can’t exceed the once a year restrict.

2. What Happens if I Exceed the Income Limits for a Roth IRA?

If your earnings exceed the bounds for a Roth IRA, you may don’t forget a backdoor Roth IRA conversion, which includes contributing to a Traditional IRA and then converting it to a Roth IRA.

3. Are IRA Contributions Tax-Deductible?

Traditional IRA contributions can be tax-deductible, depending on your income and whether or not or not you’re included through manner of a workplace retirement plan. Roth IRA contributions are not tax-deductible.

4. Can I Withdraw Money from My IRA for Emergencies?

While it’s viable, early withdrawals from a Traditional IRA also can incur taxes and consequences. Roth IRAs offer more flexibility, as you could withdraw contributions (but not income) penalty-unfastened.