In today’s fast-paced world, saving money is more essential than ever, especially if you’re raising twins or managing a large family. Whether setting aside funds for a big purchase, building an emergency fund, or planning for retirement, having a strong savings strategy is crucial. According to a 2025 Bank rate survey, 56% of Americans cannot cover a $1,000 emergency expense, highlighting the urgent need for effective money-saving habits.

The good news? Saving money doesn’t have to mean sacrificing your lifestyle. With the right approach, you can build wealth while enjoying life, whether you’re saving for a home, a car, or your twins’ future. Below, we’ll explore the best ways to save money, including actionable tips for families with twins, homebuyers, and long-term investors.

Why Saving Money Matters

Before diving into strategies, understand why saving is crucial:

✅ Financial Security – A safety net for emergencies (especially important for parents of twins).

✅ Goal Achievement – From vacations to building a house or buying a car.

✅ Stress Reduction – Financial stability improves mental health.

✅ Wealth Building – Savings grow through smart investments.

A Federal Reserve report found that 40% of Americans don’t have $400 in savings—don’t be part of that statistic!

1. Create a Budget and Stick to It

Why It’s Essential: A budget tracks income/expenses and prevents overspending (a must for parents of twins managing double the costs!).

How to Start:

- Use apps like Mint, YNAB, or Every Dollar.

- Follow the 50/30/20 rule:

- 50% Needs (rent, groceries, childcare for twins)

- 30% Wants (dining out, entertainment)

- 20% Savings/Debt (emergency fund, retirement)

💰 Pro Tip: Automate savings with direct deposits—“pay yourself first.”

2. Cut Unnecessary Expenses

Easy Ways to Save Money:

- Cancel unused subscriptions (streaming, gyms, magazines).

- Cook at home instead of dining out (meal prepping saves $200+/month).

- Implement a 24-hour “cooling-off” rule for impulse buys.

📌 Example: Cutting 65/month on subscriptions saves 65/month on subscriptions saves 780/year—money that could go toward your twins’ education fund!

3. Save for Specific Goals

Ways to Save Money When Building a House

- Compare contractor quotes and negotiate.

- Use reclaimed materials for finishes.

- DIY smaller projects (painting, landscaping).

Best Way to Save Money for a Car

- Set a monthly savings target (e.g., 300/monthfor2years=300/monthfor2years=7,200).

- Buy used or opt for fuel-efficient models.

- Refinance auto loans for lower rates.

Best Way to Save Money for Kids (Especially Twins!)

- Open a 529 college savings plan (tax-free growth).

- Buy secondhand clothes/toys (Facebook Marketplace, thrift stores).

- Teach kids frugal habits early (allowance for chores).

4. Leverage Discounts and Smart Shopping

Clever Ways to Save Money:

- Use cashback apps (Rakuten, Honey).

- Stack coupons (check Coupons.com, RetailMeNot).

- Shop holiday sales (Black Friday, back-to-school deals).

📌 Example: Saving 20/week on groceries’ 20/week on groceries 1,040/year—enough for a family vacation!

5. Reduce Monthly Bills

Ways to Save Money at Home:

- Switch to LED bulbs and ENERGY STAR appliances.

- Lower the thermostat by 2°F in winter.

- Cancel unused subscriptions (check your bank statements).

💡 For Parents of Twins:

- Bulk-buy diapers & formula (Costco, Amazon Subscribe & Save).

- Hand-me-downs save thousands per year.

6. Pay Off High-Interest Debt

The Best Way to Save Money Fast:

- Debt Avalanche Method – Target high-interest debts first.

- Consolidate loans for lower rates.

📌 Example: Paying off a 5,000creditcardat205,000creditcardat201,000/year in interest!

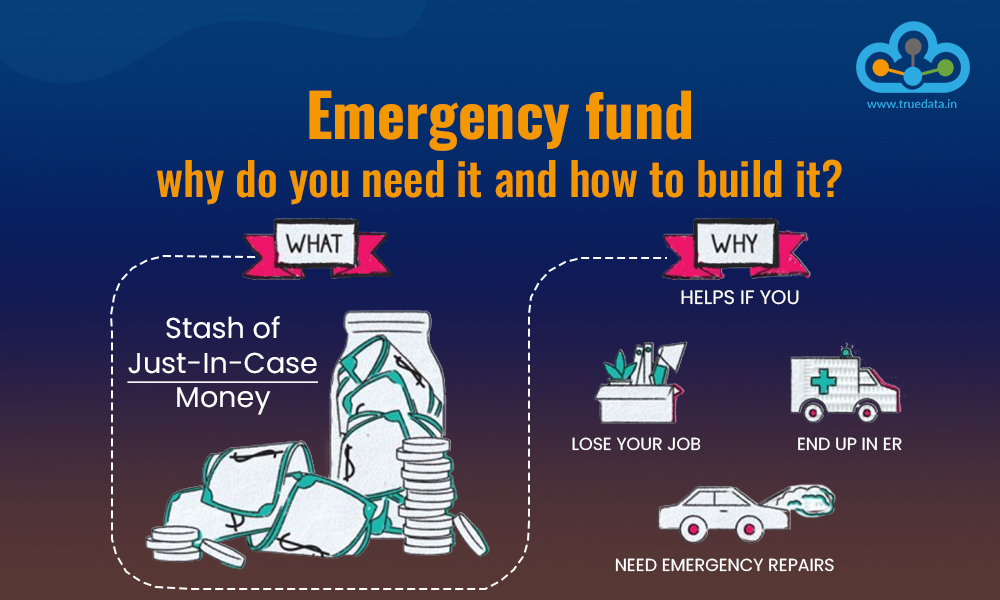

7. Build an Emergency Fund

Why It’s Critical (Especially for Twins!)

- Aim for 3–6 months’ expenses (medical bills, unexpected costs).

- Start small ($50/month) in a high-yield savings account (Ally, Marcus).

8. Invest for Long-Term Growth

Easiest Ways to Save Money for the Future:

- Contribute to a 401(k) or IRA (employer matches = free money!).

- Invest in low-cost index funds (Vanguard, Fidelity).

- Explore real estate (rental properties, REITs).

Conclusion: Start Saving Today!

From building a house to saving for your twins’ future, these strategies make financial freedom achievable. Start small, stay consistent, and watch your savings grow.

🚀 Take Action Now:

1️⃣ Track your spending (know where your money goes).

2️⃣ Set a savings goal (emergency fund, car, house, kids).

3️⃣ Automate savings (make it effortless).

💬 What’s your favorite money-saving tip? Share below!

FAQs: Quick Money-Saving Answers

1. What’s the best way to save money fast?

→ Cut discretionary spending (dining out, entertainment) + sell unused items.

2. How to save money each month?

→ Automate savings + track every expense (apps help!).

3. Should I pay off debt or save first?

→ Prioritize high-interest debt while saving a small emergency fund ($1,000).

4. How can parents of twins save more?

→ Buy in bulk, use hand-me-downs, and leverage tax-advantaged accounts (529 plans).