Imagine incomes a steady flow of earnings without lifting a finger. Sounds too exact to be proper? Welcome to the world of dividend investing—a established method that lets in you to construct wealth through the years while generating passive earnings. Whether you’re a seasoned investor or simply beginning, dividend making an investment can be an effective tool to acquire monetary independence.

In this comprehensive manual, we’ll explore dividend-making investment techniques that assist you in maximizing returns, minimizing risks, and creating a reliable profit flow. From the fundamentals to superior techniques, this article will equip you with actionable insights to make informed decisions. Let’s dive in!

What is Dividend Investing?

Dividend investing involves shopping stocks in businesses that regularly distribute a component of their income to shareholders. These bills, called dividends, are commonly made quarterly and provide traders with a consistent income movement. Unlike growth stocks, which depend on fee appreciation, dividend-paying stocks provide a twin benefit: earnings + capability capital gains.

Why Dividend Investing?

- Passive Income: Dividends offer everyday coins glide, even at some point of marketplace downturns.

- Compounding Power: Reinvesting dividends can drastically boost lengthy-term returns.

- Lower Volatility: Dividend-paying shares tend to be much less volatile than non-dividend shares.

- Inflation Hedge: Many groups boom dividends through the years, supporting you keep tempo with inflation.

According to a have a look at with the aid of Hartford Funds, dividend-paying stocks have accounted for almost 84% of the entire go back of the S&P 500 due to the fact 1960. This highlights the importance of dividends in building long-time period wealth.

Key Dividend Investing Strategies

To succeed in dividend making an investment, you need a clean method tailored to your financial desires and chance tolerance. Below are a few verified strategies to don’t forget:

1. The Dividend Aristocrat Approach

Dividend Aristocrats are organizations which have improved their dividends for as a minimum 25 consecutive years. These corporations are often well-installed, financially strong, and much less liable to financial downturns.

Examples:

- Johnson & Johnson (JNJ)

- Coca-Cola (KO)

- Procter & Gamble (PG)

- Why It Works:

- Reliable income increase.

- Strong music report of performance.

- Lower threat in comparison to more recent organizations.

Actionable Tip: Use a stock screener to discover Dividend Aristocrats and build a varied portfolio.

2. High-Yield Dividend Investing

This approach makes a specialty of stocks with above-common dividend yields. While high-yield stocks can offer massive profits, they frequently come with higher dangers.

Examples:

- AT&T (T)

- Verizon (VZ)

- Real Estate Investment Trusts (REITs)

- Why It Works:

- Attractive income potential.

- Ideal for profits-focused investors.

Caution: High yields can from time to time sign economic hassle. Always studies the organization’s basics before making an investment.

3. Dividend Growth Investing

Dividend increase investing makes a specialty of groups that continually boom their dividend payouts over the years. These companies might not offer the highest yields first of all; however, their developing dividends can lead to substantial income growth.

Examples:

- Microsoft (MSFT)

- Apple (AAPL)

- Visa (V)

- Why It Works:

- Compounding effect of growing dividends.

- Potential for capital appreciation.

Actionable Tip: Look for businesses with a robust history of sales and income increase.

4. DRIPs (Dividend Reinvestment Plans)

A DRIP lets in you to automatically reinvest dividends to buy additional shares of the inventory. Over time, this can cause exponential boom to your portfolio.

Why It Works:

- Harnesses the electricity of compounding.

- Eliminates the need for guide reinvestment.

Actionable Tip: Check if your brokerage offers DRIPs or installation a comparable reinvestment plan.

5. Sector-Specific Dividend Investing

Certain sectors are acknowledged for his or her high dividend payouts. By focusing on those sectors, you could build a portfolio with sturdy earnings capacity.

Top Sectors for Dividends:

- Utilities: Stable cash flows and high yields.

- Consumer Staples: Resilient at some stage in monetary downturns.

- Energy: Often offers high yields but may be unstable.

- Actionable Tip: Diversify across sectors to reduce hazard and decorate returns.

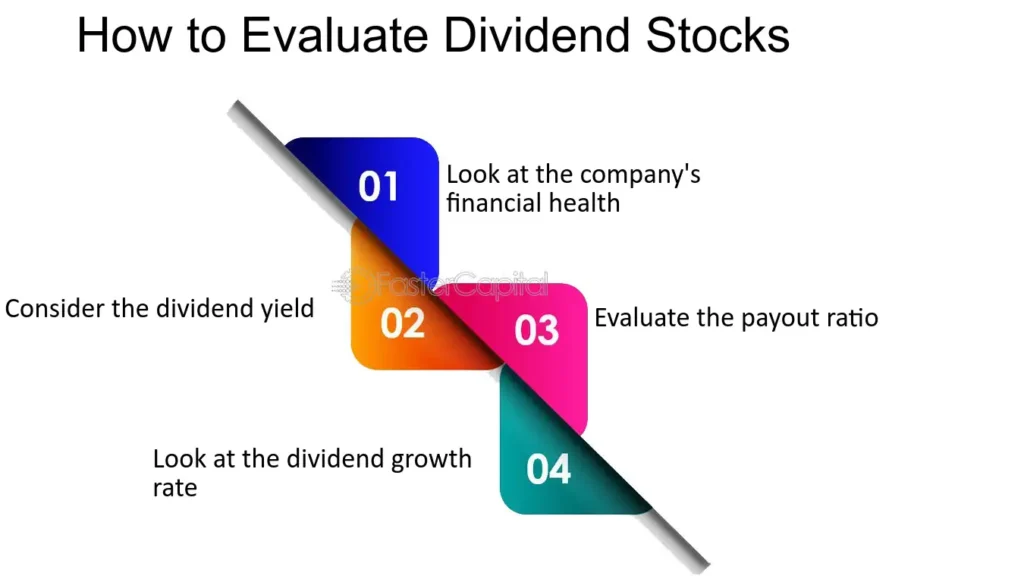

How to Evaluate Dividend Stocks

Not all dividend stocks are created same. To make knowledgeable selections, bear in mind the subsequent metrics:

1. Dividend Yield

The dividend yield is the yearly dividend charge divided via the inventory price. While a excessive yield is attractive, it’s vital to make sure the dividend is sustainable.

Formula:

Dividend Yield=Annual Dividend consistent with Share Stock Price×100Dividend Yield=Stock Price Annual Dividend in keeping with Share ×one hundred

2. Payout Ratio

The payout ratio measures the proportion of profits paid out as dividends. A lower ratio (under 60%) is generally more secure, as it suggests the organization has room to grow its dividend.

Formula:

Payout Ratio=Dividends in step with Share Earnings in line with Share×100Payout Ratio=Earnings per Share Dividends according to Share ×one hundred

3. Dividend Growth Rate

This metric indicates how quickly a corporation’s dividend is developing. Look for organizations with a constant music document of increasing dividends.

4. Financial Health

Evaluate the organization stability sheet, cash float, and debt levels. A financially wholesome organization is much more likely to sustain and develop its dividends.

Risks of Dividend Investing

While dividend investing gives many benefits, it’s no longer without dangers. Here are some ability pitfalls to look at out for:

- Dividend Cuts: Companies may also reduce or remove dividends during tough instances.

- Interest Rate Sensitivity: Dividend stocks can underperform whilst interest rates upward push.

- Overconcentration: Focusing too closely on excessive-yield shares can increase threat

- Mitigation Strategy: Diversify your portfolio and awareness on groups with strong fundamentals.

Conclusion: Start Your Dividend Investing Journey Today

Dividend investing is a time-tested method for building wealth and producing passive earnings. By knowledge the special techniques, evaluating shares carefully, and dealing with risks, you may create a portfolio that offers steady returns.

Key Takeaways:

- Focus on Dividend Aristocrats and dividend increase stocks for reliability.

- Use DRIPs to harness the power of compounding.

- Diversify throughout sectors to reduce chance.

Ready to take the following step? Start researching dividend-paying stocks today and take control of your monetary future. Share your mind or questions inside the comments below—we’d love to hear from you!

FAQs About Dividend Investing

1. What is a superb dividend yield?

A precise dividend yield usually tiers between 2% and 6%. However, usually don’t forget the enterprise’s financial health and increase potentialities.

2. How regularly are dividends paid?

Most organizations pay dividends quarterly, but a few may also pay month-to-month, semi-annually, or yearly.

3. Can I stay off dividend profits?

Yes, with a nicely-built portfolio, it’s possible to live off dividend profits. Aim for a assorted portfolio with a mixture of high-yield and dividend boom stocks.

4. Are dividends taxable?

Yes, dividends are typically taxable. However, certified dividends are taxed at a lower rate than ordinary earnings.